Dr. Mohamud Ahmed (Buyow)

The objective of this policy paper is to advise the Ministry of Finance, Federal Government of Somalia on the current constraints to domestic revenue collection in Somalia and then to suggest a number of revenue collection strategies to enhance future performance and improve transparency and accountability in Somalia’s revenue collection system.

Country Economic over view

Over the past five years, Somalia has marked important milestones in rebuilding its economy and normalizing relations with international financial institutions. In 2012, Somalia emerged from nearly two decades of civil war. However, the post-war social and economic conditions remain difficult, poverty is widespread, and more than half of the working-age population is unemployed.

Nominal GDP is estimated to have grown by 5 percent in 2015 and by 6 percent in 2016. As in the recent past, Somalia’s GDP growth continues to be urban-based, consumption driven, and fueled by remittances and donor support. (IMF 2017).

Exports of goods and services remain low largely because of the cost of conflict, including damage to vital infrastructure, security checks, roadblocks and the shutdown of trade routes—all of which constrain exports. Remittances—estimated at 24 percent of GDP in 2015—remain a lifeline for the economy.

Current Revenue Collection System and Its Status

Currently, the Somali Government’s major domestic revenue sources are generated from custom duty (mainly from Port and Airport of Mogadishu), Inland revenue and external grants.

The domestic revenue is very low and Somalia relies heavily on external assistance which mostly focuses on the social and security sectors. Effective sales tax and Value Added Tax(VAT) system were not in placed.

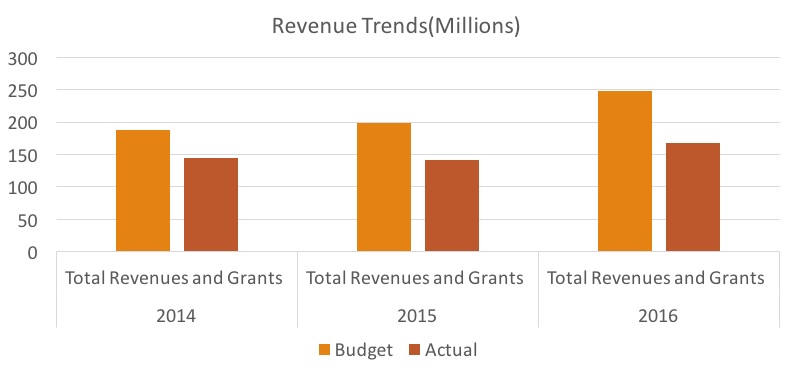

Revenue Trends: 2014-2016

Figure 1 Revenue and Expenditure Trends

Sources: Ministry of Finance, Somalia (March 2017)

Current Challenges and Constraints of Revenue Collection

Several factors hinder revenue mobilization. Somalia’s economy is largely informal, with most of the population engaged in pastoral and agricultural activities. As a result, the revenue base is narrow. Most of the country’s ports and airports (its main revenue-generating assets) are not under the full control of the Federal Government of Somalia. (FGS)World Bank Group, 2017)

Mechanisms for ensuring that revenue is collected and fully accounted for are weak. No reliable database on taxpayers exists. There is no clear system of revenue allocation between the FGS and state governments. The current situation, in which the FGS collects all its revenue from Mogadishu, is not sustainable with poor performance of income and business taxes. (World Bank Group,2017)

Weak technical and institutional capacity makes it challenging to introduce direct taxation. Taxes have been collected by tax administrators with little experience or knowledge of the tax system and collection procedures. All taxes have been collected manually, without Information Communication and Technology(ICT) or means of transportation.

The Significance of Automation Revenue Collection

Automation is the use of automatic equipment in the process rather than manual. In this paper, Automation we mean that the revenue collection is done in a computerized system using the technology rather than doing it in a manual way.

Automation has long been important in tabulating and analyzing statistical data, which are necessary for tax planning and compliance measurement. It gives a clear picture of revenue sources, which enables Inland Revenue to conduct detailed analysis and forecasting. Automation also allows revenue to be captured at the point of payment the current manual process delays revenue posting, which can lead to data inaccuracy or manipulation.

The government identified automation as the best way to increase efficiency and transparency in collection. Automation reduces revenue leakages associated with manual and opaque processes. Once rates and revenue streams are automated and tax proceeds are recorded into the system, there will be less room for manipulation and anomalies. (World Bank Group,2017).

The Impact of Automation Revenue Collection on Trade and Economic Development

Revenue automation will have a positive impact and contribute to development of trade and economic through increasing custom efficiency, enhanced citizen’s confidence, transparency and accountability, trade facilitation which leads to the increase of revenue improved trade facilitation thus resulting improve of trade and economic development.

It should also secure adequate revenue which is essential to develop and sustain the fiscal responsibility that is needed to promote growth, and to reduce long term reliance on external funding flows, particularly development aid. (Deloitte Development LLC,2015)

Recommendations

| Revenue Mobilization

|

The FGS can take a series of revenue mobilization actions in the short and medium term. | |

| Modernizing Revenue Collection | Prepare and implement a plan to modernize revenue collection by federal, state, and local authorities. | |

|

Taxpayer System and information and communication technology (ICT) |

Establish computerized taxpayer registers. Introduce cash registers for value added tax and establishing a tax identification number (TIN) system and Introduce information and communication technology (ICT) for revenue automation | |

| Improve Institutions and Staff Capacity Building |

Provide staff capacity building and skills development and apply international standards and rules for revenue collection and the taxation system |

Dr. Mohamud Ahmed (Buyow)

Email: [email protected]

________

References

IMF, 2016 Article IV Consultation with Somalia Report, February 2017

World Bank Group, Somalia Economic Outlook: Mobilizing Domestic Revenue, July 2017

Deloitte Development LLC., 2015: Tax Management Consulting

IMF (International Monetary Fund). 2011. “Revenue Mobilization in Developing Countries.” Washington DC.

We welcome the submission of all articles for possible publication on WardheerNews.com. WardheerNews will only consider articles sent exclusively. Please email your article today . Opinions expressed in this article are those of the author and do not necessarily reflect the views of WardheerNews.

WardheerNew’s tolerance platform is engaging with diversity of opinion, political ideology and self-expression. Tolerance is a necessary ingredient for creativity and civility.Tolerance fuels tenacity and audacity.

WardheerNews waxay tixgelin gaara siinaysaa maqaaladaha sida gaarka ah loogu soo diro ee aan lagu daabicin goobo kale. Maqaalkani wuxuu ka turjumayaa aragtida Qoraaga loomana fasiran karo tan WardheerNews.

Copyright © 2024 WardheerNews, All rights reserved